Submarket 3

https://www.regionalhousingsolutions.org/submarket/3

https://www.regionalhousingsolutions.org/submarket/3

Jump to:

Higher density urban, high income, young, high home prices and rents

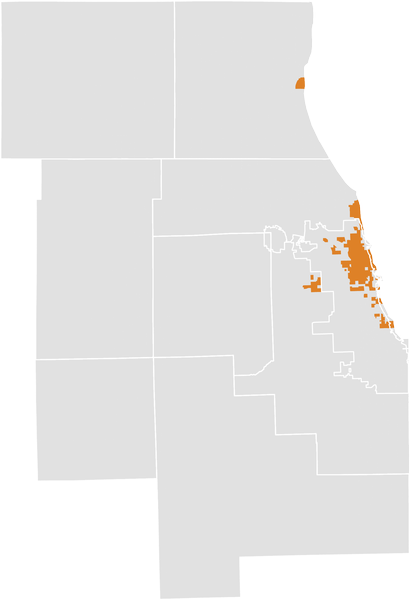

The majority of submarket 3 falls within the boundaries of Chicago, as well as parts of Oak Park and Evanston and can generally be characterized as a strong urban market. High and growing incomes generally mitigate high and increasing home prices and rents, resulting in lower levels of cost burden. Submarket 3 has the lowest transportation costs of any submarket. The housing stock can be characterized as high density urban, primarily consisting of older homes. While many residents of this submarket rent, only in submarket 3 did the share of households renting decline. Lower levels of subsidized housing are found in this submarket. Submarket 3 has a very active housing market with high levels of mortgage activity, turnover, and low vacancy. There are low levels of foreclosure activity and cash sales. The households in this submarket are younger, middle and higher income, with high levels of educational attainment. Smaller households, often 1-person, with few children fit the submarket’s high-density design. Submarket 3 was the only submarket to see an increase in median household income.

How much of each chicago community is in Submarket 3.

How much of each municipality is in Submarket 3.

How much of each county is in Submarket 3.

Quantitative analysis and many interviews with housing experts from across the region helped identify issues facing the region’s housing markets, as well as potential solutions. Although many more housing and non-housing issues affect this submarket, the housing issues and strategies identified below represent the most significant challenges and most promising solutions in this submarket. The outlined strategies feature proven projects, programs, or other efforts undertaken in communities across the region to address similar challenges or capitalize on similar opportunities.

Community resistance can stymy new housing options. Despite the higher incomes for some submarket 3 households, developers do not report frequent community resistance issues relative to other submarkets. Some believe this is because of the greater mix of ages and incomes present in submarket 3. Others feel this is because many submarket 3 communities have a natural constituency of non-profits, community organizations, and residents who will support new development, including for low-and moderate-income households. A few mentioned the value of strong political leadership in setting the tone for a desire for balanced housing types and acceptance of people from across the income spectrum. That said, resistance in submarket 3 is less than in other areas, but not absent. Some projects do run into resistance due to concerns about parking, traffic, density, height, and income of occupants.

Strong markets come with benefits and issues. Submarket 3 neighborhoods are among the strongest housing markets in the region. Such strength allows the market to address housing issues that many other areas struggle with, including an older housing stock. Yet, that strong demand makes it challenging to preserve housing opportunities for current residents. Price and rent increases can drive out existing residents. Demand for smaller rental units is strong enough relative to sales prices that developers are de-converting condominiums into apartments. Demand for single-family homes is so much stronger than rentals that developers tear down multiple rental units to build a smaller number of single-family homes. Market specialists think that demand will not abate in the near future since these areas are often close-in with good job and transit access and a form attractive to many households.